995 จำนวนผู้เข้าชม |

D Health Plus, Awarded Health insurance of The Year

![]() Get comprehensive coverage that goes beyond basic healthcare, providing additional benefits to help you live life to the fullest.

Get comprehensive coverage that goes beyond basic healthcare, providing additional benefits to help you live life to the fullest.

![]() Providing comprehensive coverage for a fulfilling life, allowing you to plan your health in advance and protect your savings during illness.

Providing comprehensive coverage for a fulfilling life, allowing you to plan your health in advance and protect your savings during illness.

![]() Lump sum coverage up to 5 million Baht per hospitalization

Lump sum coverage up to 5 million Baht per hospitalization

![]() Coverage for hospital admission including OPD benefit for continuous treatment and rehabilitation.

Coverage for hospital admission including OPD benefit for continuous treatment and rehabilitation.

![]() It covers standard single room fee, ICU room fee, doctor fee, medication fee, examination fee, surgery fee and physical therapy fee.

It covers standard single room fee, ICU room fee, doctor fee, medication fee, examination fee, surgery fee and physical therapy fee.

![]() OPD coverage for major and minor surgery

OPD coverage for major and minor surgery

![]() OPD coverage for injury from an accident within 24 hours

OPD coverage for injury from an accident within 24 hours

D Health Plus

Get It Easily and Be Covered to the Max

![]() Be covered to the max

Be covered to the max

Coverage for cancer, kidney disease, critical illnesses, common diseases, epidemics and accidents![]() Room benefits

Room benefits

Hospitalized in a standard single room in any hospital![]() Choose what suits you

Choose what suits you

Lump sum payment option since the first Baht or deductible option for more affordable premium![]() Customize as needed

Customize as needed

After retirement, you can reduce deductible amount for higher coverage. No health declaration required![]() Plus ultimate coverage as you wish

Plus ultimate coverage as you wish

Maternity Plus and Well-Being Plus

Enjoy the freedom to choose your ideal coverage that suits your needs and preferences perfectly.

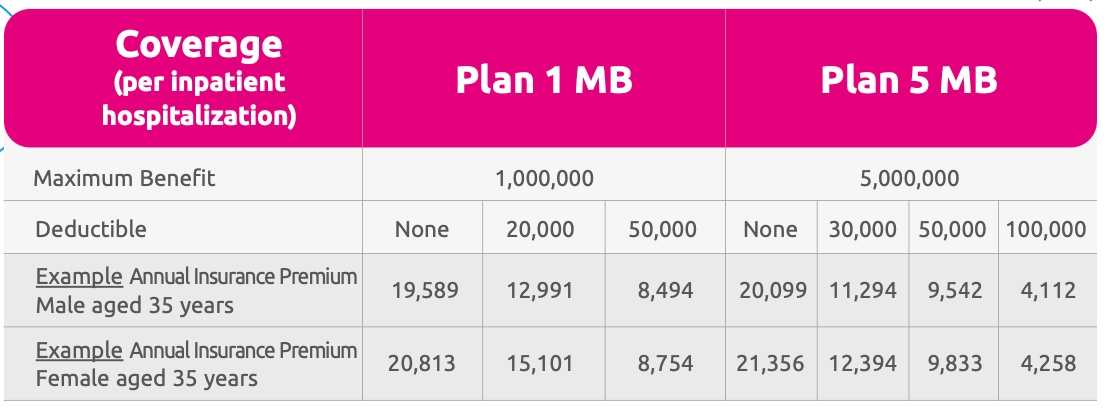

Remark : This premium is not include life insurance premium

Who should purchase D Health Plus

Scenario 1

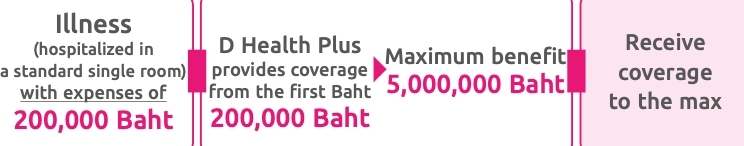

If you are someone who do not have existing welfare benefits. For example, you are a self-employed individual, this plan is an ideal choice for you.

As a 35-year-old male, opting for the 5 MB plan of D Health Plus without a deductible would require an annual premium of 20,099 Baht.

This comprehensive coverage ensures that you have the necessary financial protection for your healthcare expenses. By investing in D Health Plus, you can prioritize your well-being without relying on employer-provided insurance, making it a valuable option.

Scenario 2

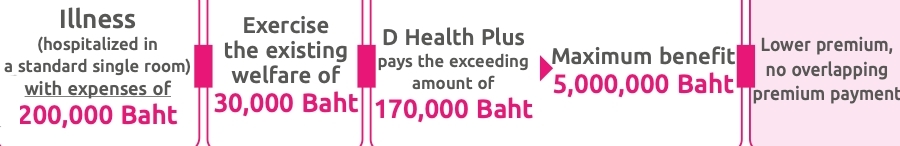

D Health Plus is also beneficial for salaried employees who have existing welfare benefits but are looking to enhance their coverage.

If you are a 35-year-old male with a salary that already provides a welfare benefit of 30,000 Baht, purchasing the 5 MB plan of D Health Plus with a deductible of 30,000 Baht would require an annual premium of 11,294 Baht.

This plan supports your existing coverage, offering additional financial protection for medical expenses beyond what your current welfare benefit provides. By investing in D Health Plus, you can enjoy the flexibility to customize your insurance to meet your specific needs. It serves as a valuable add-on for salaried employees seeking enhanced protection.

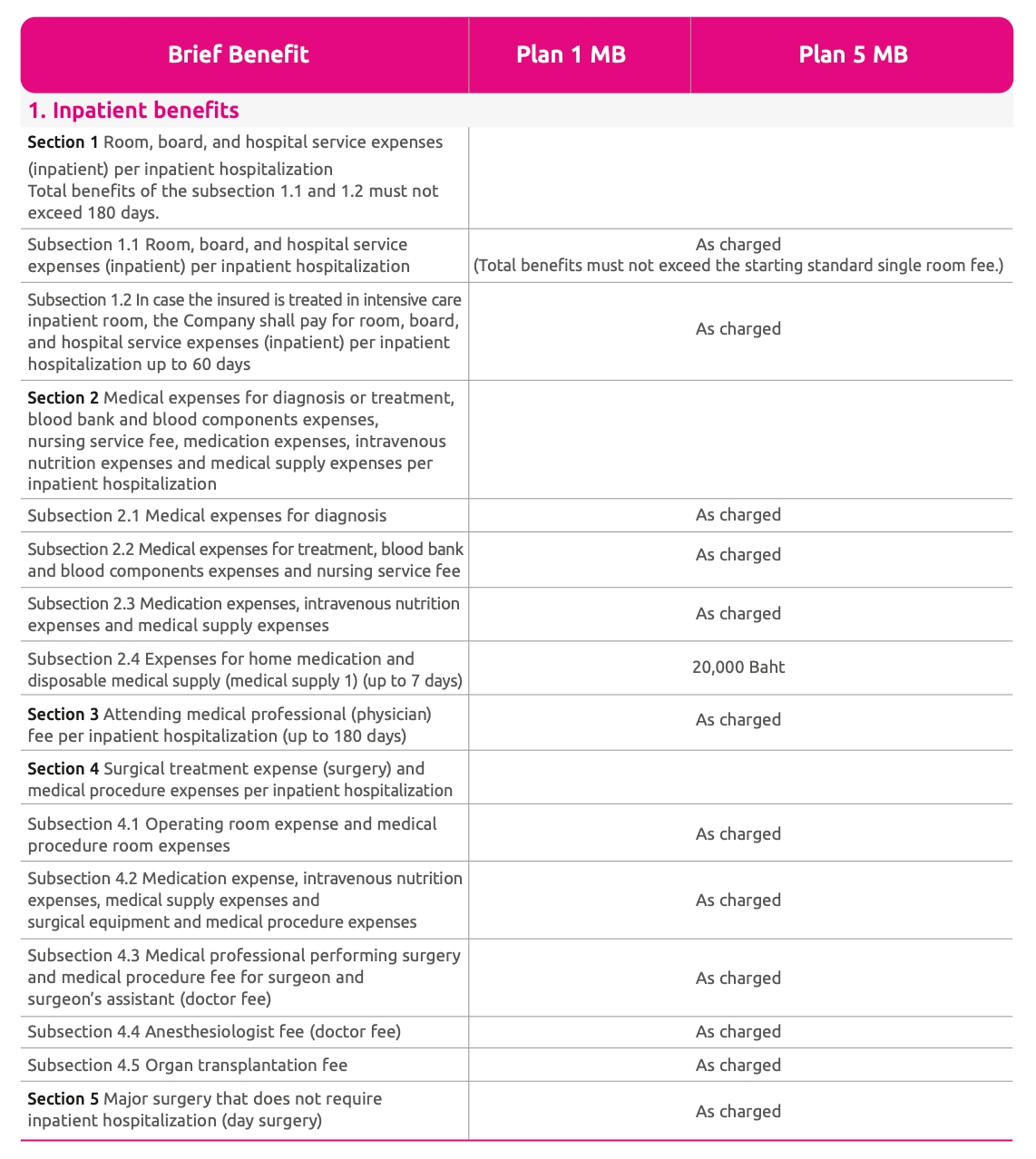

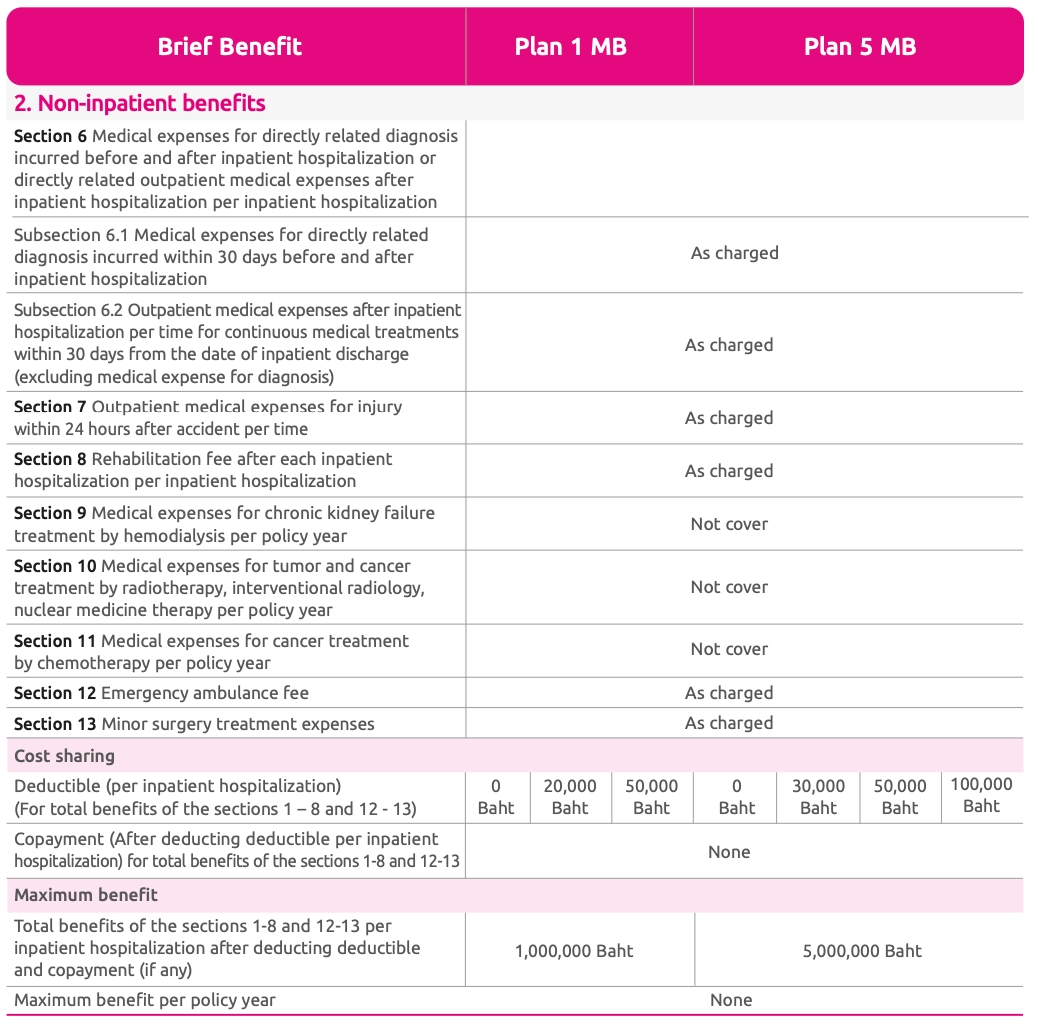

Coverage Schedule of D Health Plus

The Company will pay the following benefits for the expenses which arise from medical treatment based on medical necessity and medical standard according to general service rate for the items stated in the benefit schedule in accordance with the actual expense after deducting deductible (if any) but not exceeding the benefit specified in the benefit schedule of this rider.

==================

Ask for your Premium or Any question :

Napatcha Pongwattanakitkul, CFP®, MDRT2021-2023

Line ID : napatcha0088

or click here https://line.me/ti/p/S4ZgdTCQoS

==================

![]() Remark : The coverage area of D Health Plus Rider is Thailand only.

Remark : The coverage area of D Health Plus Rider is Thailand only.

1,000,000 Baht Per Inpatient Hospitalization

5,000,000 Baht Per Inpatient Hospitalization

This rider shall provide coverage for medical treatment in Thailand. However, in cases where medical treatment is required

outside of Thailand, the Company shall provide coverage as indicated in the benefit schedule only under the following circumstances:

1) Physical injury due to accident

2) Illnesses only in case of overseas emergency according to the definition as specified in this endorsement

However, under both circumstances, the initial date of treatment at the overseas hospital must be within the first 90 days of each trip outside of Thailand. The Company shall provide coverage for necessary and reasonable expenses that are incurred due to treatments according to medical necessity and medical standard of that particular country.

* "Per Inpatient Hospitalization" refers to the coverage provided for each instance of hospitalization as an inpatient. It includes both traditional inpatient hospital stays as well as treatments that require hospitalization for a shorter period, such as day case surgery.

The coverage applies to each individual occurrence of hospitalization or major surgery, regardless of how many times it may happen due to the same injury or illness that has not been fully cured. This includes any related or ongoing complications associated with the initial condition.

However, if subsequent hospitalizations occur within 90 days of the last discharge date, they will be considered part of the same hospitalization. In other words, if there is a gap of less than 90 days between hospitalizations, they will be treated as a continuation of the previous hospitalization rather than separate instances.

What is Convertible Option

It means that you can change the "D Health Plus plan" to Suit Your Needs later

You can choose to reduce deductible without health declaration required during the age of 55-65 while having D Health Plus for at least 5 consecutive years. Conditions are as specified by the Company.

For example Change of plan based on age range

Salaried employees can make the right plan in every stage of life. Your plan will not be disturbed because we provide you with continuous coverage.

When you're at the age of 35 during the working stage, you have existing welfare. Choose plan with deductible for lower premium, no overlapping premium payment

Once, when you're at the age of 55 upon retirement, you have no existing welfare anymore. Exercise convertible option and choose plan between "No deductible" or "Reduce deductible"

(subject to the rules) for consistency with changing welfare

====================

Ask for your Premium or Any question :

Please do not hesitate to add me

Napatcha Pongwattanakitkul, CFP®, MDRT2021-2023

Life Insurance Advisor and Muangthai Life Manager

Life Insurance License No. 5401078254

Securities Investment License No. 086641

Line ID : napatcha0088

or click here https://line.me/ti/p/S4ZgdTCQoS

Disclaimer: This English translation is intended for reference only. The Thai version shall be the only legally binding version. In the event of discrepancy between the Thai version and the English translation, the Thai version shall always prevail.